Lawyers for Harvard University and the Trump administration sparred in federal court in Boston on Monday over the administration’s decision to slash roughly $2.6 billion in federal research funding for the university – the latest in a series of high-stakes court clashes that have pitted the Trump administration against the nation’s oldest university.

Harvard sued the Trump administration in April over the funding freeze, which it described in its lawsuit as an unlawful and unconstitutional effort to assert federal ‘control’ over elite academic institutions, according to a filing submitted to U.S. District Judge Allison Burroughs.

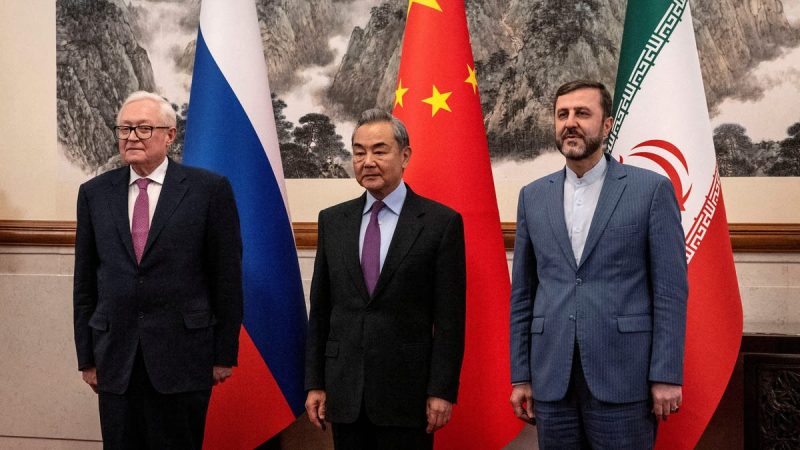

The Trump administration, for its part, has accused Harvard of ‘fostering violence, antisemitism, and coordinating with the Chinese Communist Party on its campus,’ and refusing to comply with demands from a federal antisemitism task force sent to the university earlier this year.

Both sides have asked Burroughs, an Obama appointee, to issue a summary judgment by early September, which could allow them to avoid a lengthy trial before the start of the new school year.

In court on Monday, Harvard lawyer Steven Lehotsky argued that the funding cuts are an illegal attempt by the Trump administration to coerce the university into complying with the administration’s policies and violate the First Amendment and Title VI protections.

Lawyers for Harvard have argued that the Trump administration’s actions amount to an unconstitutional ‘pressure campaign’ to influence and exert control over its academic programs, which Lehotsky echoed on Monday.

He told Burroughs the funding freeze is an attempt by the Trump administration to control the ‘inner workings’ of the university, and one he argued could cause lasting damage.

He pointed to earlier claims from Harvard that the administration ‘fails to explain how the termination of funding for research to treat cancer, support veterans, and improve national security addresses antisemitism.’

‘By accepting federal funds, Harvard agreed to abide by the provisions in Title VI and the relevant agencies’ corresponding regulations,’ lawyers for the university said in filing the lawsuit earlier this year.

But Harvard’s agreement, they said, does not constitute a ‘blank check for agencies to impose the government’s recent, unrelated demands as a condition of continued funding.’

Meanwhile, Michael Velchik, a lawyer for the Justice Department, countered that the administration has ‘every right’ to cancel the funding, which they sought to frame as a mere contract issue and one that should be heard in a different court.

The Justice Department also reiterated that they see Harvard’s actions as violating the administration’s order combating antisemitism.

‘Harvard claims the government is anti-Harvard. I reject that,’ Velchik said on Monday. ‘The government is pro-Jewish students at Harvard. The government is pro-Jewish faculty at Harvard.’

President Donald Trump signaled dissatisfaction with the hearing on Monday – vowing on social media to appeal any ruling against the administration to a higher court.

He also took aim at Burroughs. ‘How did this Trump-hating Judge get these cases?’ he said on Truth Social, ‘When she rules against us, we will IMMEDIATELY appeal, and WIN,’

Trump further took aim at Harvard, accusing the university of being ‘anti-Semitic, anti-Christian, and anti-America,’ despite having ‘$52 billion’ sitting in the bank.

‘Much of this money comes from the U.S.A., all to the detriment of other schools, colleges, and institutions, and we are not going to allow this unfair situation to happen any longer,’ Trump said.

Burroughs ended Monday’s hearing by saying she would take the case under advisement, and would issue a ruling after she had sufficient time to weigh the matters presented by the administration and the university.

She did not offer a timeframe for when she planned to rule on the matter.

Still, the judge appeared skeptical during the hearing of some Trump administration claims, including how it could make such wanton cuts to university funding.

At one point, Burroughs noted to Velchik that she had doubts about the government’s so-called ‘ad hoc’ decisions to cut billions in grant money without providing further evidence, documentation or procedure to ‘suss out’ whether the university or its administrators had taken sufficient steps to combat antisemItism or comply with the guidance handed down by the Trump administration.

‘The consequences of that in terms of constitutional law are staggering,’ she told Velchik at one point during the hearing.

‘I don’t think you can justify a contract action based on impermissible suppression of speech.’

Since Trump took office in January, the administration has targeted the university with investigations from six separate federal agencies.

It has also sought to ban Harvard’s ability to host international students by attempting to revoke its certification status under the Student and Exchange Visitor Program (SEVP) – a program led by the Department of Homeland Security that allows universities to sponsor international students for U.S. visas.

Burroughs in June issued a temporary restraining order blocking the administration from immediately revoking its SEVP credentials, siding with Harvard in ruling that the university would likely suffer ‘immediate and irreparable harm’ if the action was enforced.

Harvard, meanwhile, has signaled no plans to stand down in its fight with the Trump administration.

‘Ultimately, this is about Trump trying to impose his view of the world on everybody else,’ Harvard Law professor Noah Feldman said in a radio interview earlier this summer discussing the administration’s actions.

![Former special counsel David Weiss got little support from the Department of Justice (DOJ) when he sought lawyers to help prosecute President Joe Biden’s son Hunter, Weiss told Congress during a recent closed-door interview.

Amid delicate plea deal negotiations between Hunter Biden and Weiss in 2023, Weiss said he asked the DOJ deputy attorney general’s office for a team of trial lawyers and received a single resume, according to a transcript of the interview reviewed by Fox News Digital.

‘Actually, as I think about the sequencing, I had started to reach out myself directly to offices or people that I knew and make my own inquiries,’ Weiss told House Judiciary Committee staff of his struggle to hire lawyers for the sensitive job of trying the president’s son.

Weiss appeared on Capitol Hill for the interview in June as part of the committee’s inquiry into the DOJ’s years-long investigation and prosecution of Hunter Biden.

Now no longer a DOJ employee, Weiss spoke candidly for hours with the committee, shedding new light on his interactions with the Biden DOJ and giving fresh insight into why Hunter Biden was never charged with certain violations.

<strong>Who is David Weiss?</strong>

Weiss was appointed U.S. attorney of Delaware during the first Trump administration and began investigating Hunter Biden at that time. Former Attorney General Merrick Garland made Weiss special counsel in August 2023 after a plea agreement with Hunter Biden fell apart.

Republicans had accused Weiss of offering Hunter Biden a ‘sweetheart’ plea deal that involved only misdemeanors. But in an unusual move, a judge rejected the deal, leading Weiss to instead bring two successful indictments against the then-first son, one for illegal gun possession and another for nine tax charges, including three felonies.

Weiss came under enormous scrutiny by Republicans and Democrats for his handling of the investigation, which had become a hyper-political national news story centered on the salacious behavior and wrongdoings of Hunter Biden, a recovering drug and alcohol addict, and allegations that Joe Biden was complicit in his son’s crimes.

Republicans claimed Weiss was not tough enough on Hunter Biden, while Democrats said he was being treated more harshly than a typical defendant because he was the president’s son. Joe Biden ultimately granted an unconditional pardon to his son, a move widely criticized by members of both parties.

<strong>Weiss gets ‘one resume’</strong>

Weiss said during the interview that he was ‘fortunate enough to obtain a couple very excellent prosecutors,’ a reference to the two DOJ attorneys who handled trial preparations for Hunter Biden.

But, Weiss also indicated that when he first requested lawyers in the spring of 2023, he had to be self-sufficient in finding them and that the deputy attorney general’s office was unhelpful. Weiss noted he did not deal directly with former Deputy Attorney General Lisa Monaco at all and assumed she was recused from Hunter Biden’s cases.

Weiss said that at one point he ran into the director of the Executive Office for United States Attorneys, which handles recruitment, at an event and asked if any hiring progress had been made.

Weiss did not ‘have a whole lot of success’ during that conversation, he said.

‘What do you mean, you didn’t have success? … They didn’t give you lawyers?’ a committee aide asked.

‘I got one resume,’ Weiss replied.

The aide asked, ‘Nobody wanted to come prosecute Hunter Biden?’

‘I don’t want to say that because I don’t know that they weren’t trying to find people,’ Weiss said. ‘All I know was I didn’t get a whole lot of resumes.’

Weiss eventually gained two attorneys, Leo Wise and Derek Hines, who went on to secure a conviction by a jury in Delaware after a week-long trial on gun possession charges and a guilty plea to all nine of Hunter Biden’s tax charges.

A committee aide pressed Weiss on why he felt there was ‘such a drought’ of help at DOJ headquarters.

‘As I said a moment ago … I did not receive a lot of resumes in response to my initial request,’ Weiss said, noting that eventually the DOJ’s Public Integrity Section assisted him.

Asked if the Public Integrity Section helped him because Weiss proactively reached out, Weiss replied, ‘Probably.’

<strong>Burisma tax years and FARA</strong>

For his testimony, the Trump DOJ gave Weiss permission in a letter to talk to Congress about Hunter Biden’s cases. The department noted, however, that it could not authorize Weiss to talk about the former first son’s confidential tax information.

Weiss suggested, though, that he would have charged Hunter Biden for the 2014 and 2015 tax years if he could have.

‘To the extent I can put together — and this is general — a case that involves more years than not and allows me to more fully develop allegations about a course of conduct and a scheme, that’s better for the prosecution,’ Weiss said. ‘So it’s not like I’m looking to cut out years generally when you’re pursuing a tax investigation.’

During the years in question, Hunter Biden was raking in $1 million per year as a board member of the Ukrainian energy company Burisma while his father, then vice president, was overseeing foreign policy with Ukraine. The scenario became ripe for questions about conflicts of interest, in part because of suspicious interactions between Hunter Biden and the Obama State Department.

In Weiss’s final special counsel report, he dodged explaining why he brought charges of failure to pay taxes and tax evasion against Hunter Biden only for the tax years after 2015, citing Joe Biden’s pardon. Now, Weiss said, he would be more willing to talk about it if he were legally allowed to do so.

Chairman Jim Jordan, R-Ohio, pressed Weiss, saying the ‘political aspects of Burisma’ raised ‘glaring’ questions about the prosecutorial decisions made for the years for which Hunter Biden avoided charges.

‘I understand,’ Weiss replied. ‘Absolutely. Yes. And I wish that I could address it. But it’s my understanding that, for me to trip into 2014 and ’15 is a violation of [U.S. code].’

Weiss also told the committee his team had no serious discussions about charging Hunter Biden under a foreign lobby law called the Foreign Agents Registration Act.

‘We just couldn’t put together a sufficient case,’ Weiss said.

This post appeared first on FOX NEWS Hunter Biden special counsel got ‘one resume’ from DOJ to help prosecute president’s son](https://firstfingenius.com/wp-content/uploads/2025/07/Hunter-Biden-800x450-1.jpg)

![Rep. Alexandria Ocasio-Cortez, D-N.Y., is blasting people within her own party for ‘lying’ about her position during a key round of government funding votes late last week.

‘Google is free. If you’re saying I voted for military funding, you are lying. Receipts attached,’ Ocasio-Cortez wrote alongside several screenshots showing her vote ‘no’ on Republicans’ military funding bill.

‘Drag me for my positions all you want, but lying about them doesn’t make you part of the ‘left.’ If you believe neo-nazis are welcome and operating in good faith, you can have them!’

The New York City Democrat got broadsided from her left over her vote on a specific amendment aimed at blocking U.S. funding for Israel’s Iron Dome, though it did not make it into the final bill – which Ocasio-Cortez voted against.

The Democratic Socialists of America (DSA) criticized the progressive firebrand for voting against an amendment by Rep. Marjorie Taylor Greene, R-Ga., to block $500 million in Congress’ annual defense spending bill that was aimed at helping fund Israeli missile defense systems.

‘An arms embargo means keeping all arms out of the hands of a genocidal military, no exceptions. This is why we oppose Representative Alexandria Ocasio-Cortez’[s] vote against an amendment that would have blocked $500 million in funding for the Israeli military’s Iron Dome program,’ the DSA said over the weekend.

The DSA noted she did vote against the defense funding bill itself, thereby ‘voting against funding for the imperialist military-industrial complex and the Israeli genocide.’

The group added, however, ‘We were further deeply disappointed by her clarifying statement on her position on the Iron Dome.’

‘Along with other US-funded interceptor systems, the Iron Dome has emboldened Israel to invade or bomb no less than five different countries in the past two years,’ the DSA said.

‘The fact that Representative Ocasio-Cortez acknowledges that Israel is carrying out this genocide makes her support for military aid all the more disappointing and incongruous. We urge the representative to continue voting against the Iron Dome, whether it is part of a larger defense spending bill or as a stand-alone bill.’

The DSA commended Reps. Rashida Tlaib, D-Mich.; Ilhan Omar, D-Minn.; Summer Lee, D-Pa., and Al Green, D-Texas, for voting against the amendment.

Fox News Digital reached out to Ocasio-Cortez’s campaign and congressional office for comment.

She posted on X after the vote, ‘Marjorie Taylor Greene’s amendment does nothing to cut off offensive aid to Israel nor end the flow of US munitions being used in Gaza. Of course I voted against it.’

‘What it does do is cut off defensive Iron Dome capacities while allowing the actual bombs killing Palestinians to continue. I have long stated that I do not believe that adding to the death count of innocent victims to this war is constructive to its end,’ she said.

‘That is a simple and clear difference of opinion that has long been established. I remain focused on cutting the flow of US munitions that are being used to perpetuate the genocide in Gaza.’

The clash exemplifies how Israel continues to drive an ideological wedge within the Democratic Party.

It’s not the first time Ocasio-Cortez caught heat from the progressive base for failing to take a critical enough stance on Israel.

In 2021, the New York Democrat cried on the House floor after voting ‘present’ on funding Israel’s Iron Dome defense system.

‘Yes, I wept,’ she wrote in an open letter to constituents after the incident. ‘I wept at the complete lack of care for the human beings that are impacted by these decisions. I wept at an institution choosing a path of maximum volatility and minimum consideration for its own political convenience.’

The overall bill that passed last week calls for $832 billion in defense funding for fiscal year 2026.

That’s separate from the National Defense Authorization Act (NDAA), another annual bill that sets defense and national security policy each fiscal year – essentially detailing how those funds will be spent.

Greene’s amendment to strip $500 million going toward Israeli missile defense programs lost in a lopsided 6-422 vote.

This post appeared first on FOX NEWS AOC slams progressive critics for ‘lying’ about her Iron Dome stance in defense bill fight](https://firstfingenius.com/wp-content/uploads/2025/07/AP21033172891760-e1612474961202-1-800x450-1.jpg)